Service Credit

Earned Service Credit

Employee members of ERB’s Defined Benefit Plan receive service credit for each calendar quarter during which they are employed by an ERB employer and make contributions to that plan. Credit is also granted for service prior to July 1, 1957, the Defined Benefit Plan’s effective date.

Members who take a paid sabbatical or leave of absence continue to make contributions and therefore continue to earn service credit. Members who take unpaid sabbaticals or leaves of absence do not earn service credit.

Buying Back Service Credit

If you have withdrawn your contributions from ERB’s Defined Benefit Plan, you have the right to “buy back” years of service credit up to the amount withdrawn plus interest at the current rate set by ERB. This applies to both active and inactive members; however, you may not “buy back” service credit after you have retired.

There are two options to buy back service credit:

- lump sum payment, including interest, to the ERB to buy back all or part of your withdrawn service, or

- rollover or transfer from another retirement plan, including a 401(a) plan, a tax-sheltered annuity 403(b) plan, or an IRA, to the extent allowed by the IRS.

If a member decides to withdraw contributions again or dies prior to retirement, interest the member paid on restored contributions is not refundable.

Allowed Service Credit

The Educational Retirement Act allows certain types of service credit to be purchased and credited to a member’s account. This “allowed” service credit, limited to a total of five years, will be included in the computation of the retirement benefit and counted toward retirement eligibility based on the 25 and Out requirement only. Allowed service credit is not counted toward retirement eligibility based on the other retirement options however, it will apply when calculating the retirement benefit under the other retirement options. (See “Retirement Eligibility” from the NMERB Online Member Handbook in the Publications listed below for additional information.)

Allowed service credit does not count towards becoming vested in the ERB plan. To become vested in the ERB plan, the member must complete five years of earned service credit. Earned service credit is credit earned while working more than .25 FTE for an ERB covered employer.

You may purchase up to five years of service credit if you have served in the US military, the Commissioned Corps of the Public Health Service, or worked for any of the following institutions:

- A public school or institution of higher learning anywhere in the US;

- A US Military Dependents’ School;

- A federal educational program in New Mexico;

- An accredited private school or institution of higher learning in New Mexico.

Members who can combine military service and any of the other categories listed above may purchase a maximum of 10 years of service credit (up to five of allowed out of state or private school and up to five of military.)

In order to purchase service credit, you must file an application with the NMERB, and your former employer must verify your employment. Applications are available on the download forms link on this web page.

The cost to purchase service credit is based on an actuarial cost that reflects your length of service and current earnings. Please contact the NMERB to get an estimate of what it would cost you to purchase allowed service credit. You have two options for purchasing allowed service credit:

1. You may make a lump-sum payment to the NMERB

2. You may roll over or transfer retirement contributions from another retirement plan, including another 401(a) plan, a tax-sheltered annuity 403(b) plan or an IRA, to the NMERB’s Defined Benefit Plan to the extent allowed by the Internal Revenue Service (IRS).

You should roll over or transfer funds from the other retirement plan directly to the NMERB to avoid adverse tax consequences. Please consult with a tax advisor on the possible tax effects of a rollover or other transfer. The NMERB cannot provide tax advice and is not responsible for the adverse tax effects of the rollover or transfer method chosen by an individual.

Military Service

Members who previously served in the military or the commissioned corps of the Public Health Service may purchase up to five years of allowed service credit in the Defined Benefit Plan. Service credit for active duty may be purchased after five years of employment by an NMERB-covered entity. The cost to the member is the combined employee and employer contributions at the current rates. To qualify for allowed service credit, you must have received an honorable discharge and provide the NMERB with a copy of your DD-214.

The NMERB is in full compliance with the federal Uniformed Services Employment and Re-Employment Rights Act (USERRA) which ensures that individuals who service in the Armed Forces, Reserves, National Guard or other “uniformed services” are:

- Not disadvantaged in their civilian careers because of the service

- Promptly re-employed in their civilian jobs upon their return from duty

- Not discriminated against in employment based on past, present, or future military service

If you are in the National Guard or Reserves and are called to active duty while employed by an NMERB-covered entity, your pension rights under the Defined Benefit Plan are preserved under the terms of USERRA. This means that for purposes of service credit, you will be treated as if you had no break in employment with he NMERB-covered entity. while you are on active duty, neither you nor your NMERB employer makes contributions to the plan. This “free” military period relieves you from having to make contributions while you are away from your civilian career.

Please Note – Effective October 1, 2014 —

When you provide a check as payment, you authorize the State of New Mexico to either use information from your check to make a one-time electronic fund transfer from your account or to process the payment as a check transaction.

Purchase of Service Credit Based on Accumulated Sick Leave

Beginning on July 1, 2020 a member who has acquired five years of ERB earned service credit may purchase additional service credit based on the amount of unused sick leave they have accumulated. Payments made for the purchase of service credit based on sick leave are nonrefundable.

In order to purchase service credit based on accumulated sick leave a member shall:

Have completed five or more years of employment during which time employee contributions were made to NMERB:

- Be currently employed by an NMERB employer (school district, charter school, higher education institution, etc.) as an active, regular member of NMERB; and

- Make full payment to NMERB in a single lump sum. When a member applies to purchase service credit based on accumulated sick leave, NMERB will provide the member with details of how much it will cost. Actual costs will be based on current actuarial assumptions and will be different for each member based on their individual circumstances. The member must make payment within 90 calendar days of the date that the member is informed of the cost.

How much service credit can I purchase based on accumulated sick leave?

A member may convert a maximum of six days of unused sick leave per year of contributory employment into earned service credit.

You cannot purchase more than a total of four calendar quarters of service credit based on accumulated sick leave.

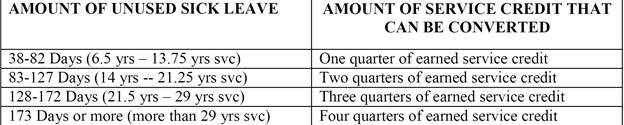

The amount of unused sick leave one needs to have accumulated in order to purchase service credit is detailed in the chart below. Eight hours of sick leave equals one day of sick leave:

For more information please see 22-11-34.1 NMSA 1978

Any sick leave for which the member has been paid or which the member has otherwise used shall not be eligible for conversion to earned service credit.

The member shall only be eligible to convert his or her own earned sick leave to earned service credit. Donated sick leave or sick leave available to the member from a sick leave bank or similar repository shall not be eligible for conversion to earned service credit.

How do I apply?

- Login to your MyNMERB account to calculate a service credit purchase estimate.

- If you choose to proceed with the application process, print out the estimate and attach it to your application.

See below for the link to the application. - Submit an application to purchase sick leave service credit on the form provided by ERB.

The LAU employing the member shall certify the number of hours of unused sick leave the member has available for conversion, and the number of hours of unused sick leave the member wishes to convert to earned service credit.

Managing the retirement assets of New Mexico Educators since 1957.

Business Information

Hours

Monday - Friday

8:00 am - 5:00 pm

Mailing Address

PO Box 26129

Santa Fe, NM 87502

Santa Fe & Albuquerque

Call Center

505-585-3510

Toll-Free

1-800-663-1919

Santa Fe & Albuquerque Fax

1-866-463-9221

Locations

Santa Fe

701 Camino de los Marquez

Santa Fe, NM 87505

Albuquerque

8500 Menaul Blvd. NE, Suite B-450

Albuquerque, NM 87112